Pictet Group

Our Climate Action Plan

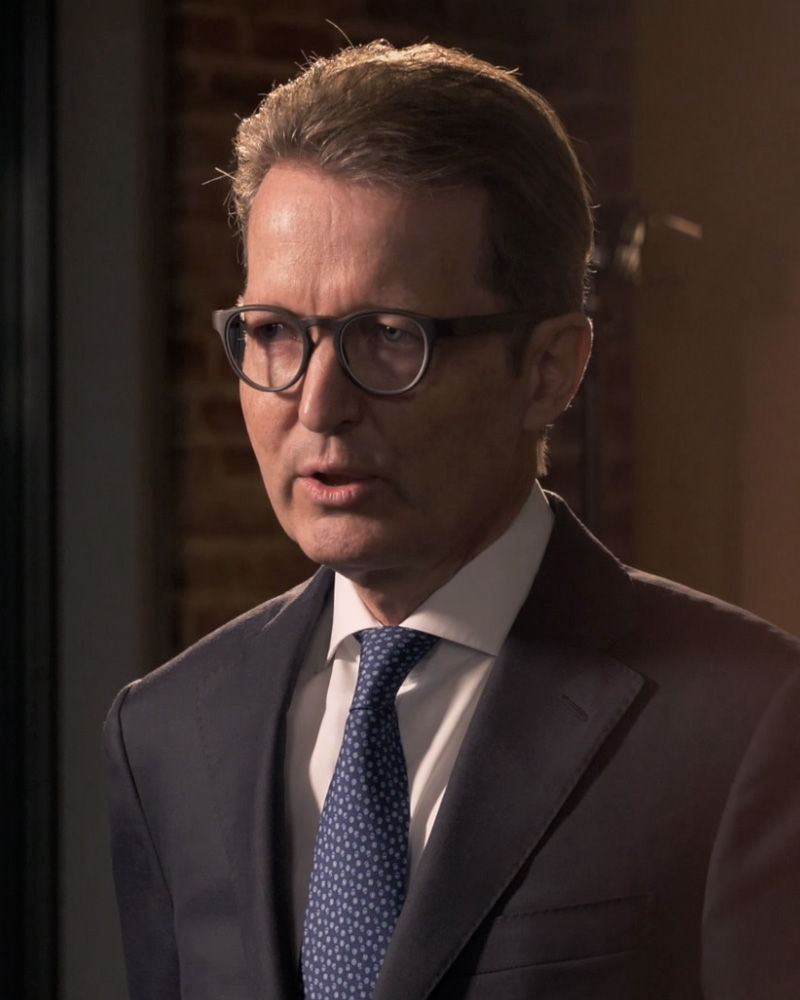

“It is our fiduciary responsibility to play an active role in accelerating the transition of the global economy towards a net-zero emissions future in line with the climate science.”

— Renaud de Planta, Senior Managing Partner

Commitments and convictions

Our convictions reflected in our Climate Investment Principles, referred to throughout this plan, underpin our commitments to the Net Zero Asset Managers and Science Based Targets initiatives.

-

1.

Climate change will have a material impact on asset prices and investment returns.

-

2.

The investment decisions taken today will have a strong bearing on how climate change and its consequences ultimately unfold.

-

3.

No economic system will be immune to the impacts of severe climate change, therefore such a risk cannot be easily diversified or hedged.

-

4.

Our governance and risk management systems must be fit to enable the delivery of this climate action plan.

Low-carbon transition targets for our investments

Pictet’s target for listed equity and fixed income

How we will achieve these targets

-

Active ownership

Engage with the issuers of our investments to set science-based targets.

-

Responsible products and solutions

Grow and launch new investment solutions that foster the low-carbon transition.

-

Advocacy and partnerships

Motivate other stakeholders join the net-zero transition.

Our target for real estate

Across our direct investments and co-investments in real estate, Pictet commits to reducing its baseline portfolio emissions intensity (in kgCO2eq per square meter) by 67% by 2030 (from 2021 levels).

The inclusion of clear actions to reduce embodied and operational GHG emissions in business plans and the retrofitting of buildings to improve energy efficiency are examples of how we plan to achieve our target.

How we will achieve these targets

-

ESG integration

Integrate climate factors into investment process to create value and attractive returns.

-

Active ownership

Engage with key stakeholders including GPs, developers, occupiers and facilities managers to enable the low-carbon transition.

-

Responsible products and solutions

Increase product offering focused on value-added strategies supporting the low-carbon transition.

Low-carbon transition targets for our operations

We commit to reducing our absolute scope 1 and 2 emissions by 55% by 2030 from 2019 levels.

Our key levers of action:

- Build a cutting-edge low-carbon HQ in Geneva and move to less fossil-intensive offices abroad

- Decarbonise our electricity consumption through Energy Attribute Certificates

- Raise awareness of climate change and improve eco-friendly behaviours

Pictet's levers of Climate Action

Clients' assets

-

ESG integration

Integrate our Climate Investment Principles and continuous improvement in climate data availability.

-

Responsible products and solutions

Grow existing strategies and launch innovative solutions focused on the low-carbon transition.

-

Active ownership

Engage with the companies and funds we invest in to set science based targets.

-

Client disclosure

Continue to provide and enhance climate-related transparency to our clients on their portfolios.

-

Research and thought leadership

Continue climate-related research with partners to inform investment decisions and maximise our positive impact.

Own assets

-

Investing our balance sheet

Continue to maintain a de-fossilised balance sheet.

-

Employee engagement

Facilitate and encourage employee involvement in climate initiatives.

-

Managing our direct environmental impact

Decarbonise our electricity consumption through Energy Attribute Certificates and move to less fossil-intensive buildings.

-

Philanthropy

Not directly incorporated in our climate action plan, our Foundation is a lever activated to address environmental issues.

-

Advocacy and partnerships

Motivate other stakeholders to be part of the transition to achieve a just low-carbon economy.

Our progress on climate change

For the past several years, we have made ongoing efforts around climate action, with this plan serving as a roadmap to continue and expand upon these in the years to come. We will also continue to be transparent on our progress on climate change.

Our governance

Tackling the climate challenge is very complex, partly because its worst effects are felt over the long term. Pictet’s governance and core business model are well suited to managing the required transition. The average tenure of our Managing Partners is 21 years, making them accountable over multiple decades for decisions taken today.